ADA Price Prediction: Analyzing the Path to $2 Amid Whale Movements and Technical Breakouts

#ADA

- Technical indicators show ADA trading above key moving average with bullish MACD momentum

- Whale activity and institutional ETF interest creating positive market sentiment

- Price targets range from $0.96 short-term to $2.08 medium-term based on technical and fundamental factors

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Support

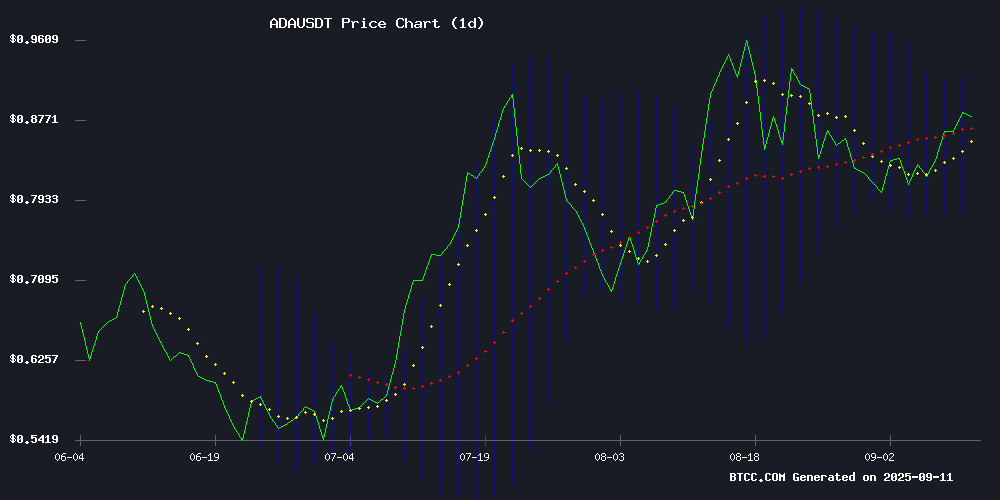

According to BTCC financial analyst Emma, ADA is currently trading at $0.8808, comfortably above its 20-day moving average of $0.8479. The MACD indicator shows bullish divergence with the signal line at 0.030582, though the histogram remains negative at -0.005546. The price is trading within the Bollinger Bands, with the upper band at $0.9104 providing immediate resistance. The current positioning suggests consolidation with potential upside toward the $0.91 level.

Market Sentiment: Whale Activity and ETF Speculation Drive Optimism

BTCC financial analyst Emma notes that despite a significant $140 million whale sell-off, ADA has maintained key support levels. Market sentiment remains positive as institutional interest grows, particularly with Grayscale's potential ETF plans fueling bullish momentum. News headlines indicate strong expectations for price targets ranging from $0.96 in the short term to $2.08 in the medium term, reflecting growing confidence in Cardano's fundamentals.

Factors Influencing ADA's Price

ADA Price Holds Key Support Despite $140M Whale Sell-Off

Cardano (ADA) is weathering a significant sell-off by large holders, with over $140 million worth of tokens dumped in recent weeks. The cryptocurrency currently trades at $0.8775, clinging to a crucial support level that has historically served as a pivot point.

Whale activity continues to suppress bullish momentum, with analysts tracking more than 140 million ADA sold since late August. This persistent offloading has prevented ADA from participating in rallies seen across other major altcoins, creating a stark divergence in market performance.

The $0.80 threshold now emerges as a critical line in the sand. A breach below this level could signal deeper corrections, while holding above may set the stage for a September rebound. Market structure remains intact despite the selling pressure, leaving traders watching for either confirmation of support or signs of breakdown.

Cardano Price Eyes $1 as Whales Drive Momentum Higher

Cardano's ADA token is gaining momentum, with its price reaching $0.8880, up 1.79% in the past 24 hours and over 8% weekly. Market cap stands at $31.74 billion, though trading volume has dipped by 28% to $1.22 billion.

Whale activity is fueling the rally, with 200 million ADA ($178 million) accumulated in two days—the largest buying spree since July 2025. This surge has increased whales' share of circulating supply to 15.4%, coinciding with ADA's breakout above the $0.89 resistance level.

Technical indicators suggest potential for further gains toward $0.95–$0.96 if buying pressure persists. The key question is whether ADA can sustain this momentum or face short-term consolidation.

ADA Price Prediction: Cardano Eyes $0.96 Breakout Target Within Two Weeks

Cardano (ADA) shows strong bullish momentum, trading at $0.88 with technical indicators suggesting a potential breakout to $0.96 within 14 days. Analysts remain conservative, with targets ranging from $0.82 to $0.88, but current price action contradicts these projections.

Key resistance levels include $0.92 (+4.5%) and the upper Bollinger Band at $0.91, while immediate support holds at $0.78. The divergence between analyst forecasts and technical setups highlights ADA's upside potential.

Cardano Price Prediction: ADA Eyes $2.08 Breakout as Grayscale ETF Plans Spark Bullish Momentum

Cardano (ADA) is reclaiming market attention with a potent mix of technical strength and institutional interest. Grayscale's disclosure of plans to stake ADA holdings within its proposed Cardano ETF (GADA) has injected fresh optimism into the ecosystem. The strategy—pending regulatory approval—would channel staking rewards back into the fund, creating a dual appeal of price appreciation and yield generation.

Technically, ADA shows resilience within an ascending channel, finding support near the $0.82-$0.84 zone. This consolidation mirrors growing conviction among traders, with breakout potential toward $2.08 if momentum sustains. The Grayscale development amplifies Cardano's staking narrative at an opportune moment, as proof-of-stake assets gain traction among yield-seeking investors.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, BTCC financial analyst Emma projects ADA could reach $0.96 within two weeks, representing a 9% upside from current levels. The medium-term outlook appears even more bullish, with potential to test $2.08 if Grayscale's ETF plans materialize and whale accumulation continues. Key resistance levels to watch include:

| Price Level | Significance |

|---|---|

| $0.9104 | Bollinger Upper Band (Immediate Resistance) |

| $0.9600 | Short-term Target |

| $1.0000 | Psychological Barrier |

| $2.0800 | Medium-term ETF-driven Target |